Analysis of Financial Statements

Notes For All Chapters Accountancy Class 12

Topic 1: Introduction to Financial Statements Analysis

1. Financial Statement Analysis It is the systematic numerical representation of the relationship of one financial fact with the other to measure the profitability, operational efficiency, solvency and the growth potential of the business.

2. Types of Financial Statement Analysis

(i) External analysis

(ii) Internal analysis

(iii) Horizontal analysis

(iv) Vertical analysis

(v) Long-term analysis

(vi) Short-term analysis

3. Process of Financial Statement Analysis

(i) Rearrangement of data

(ii) Comparison

(iii) Analysis

(iv) Interpretation

4. Importance or Objectives of Financial Statement Analysis

(i) Judging the operational efficiency of the business.

(ii) Measuring the profitability.

(iii) Measuring short-term and long-term financial position.

(iv) Indicating the trend of achievements.

(v) Assessing the growth potential of the business.

(vi) Inter-firm comparison

5. Uses or Advantages of Financial Statement Analysis

(i) Security analysis

(ii) Credit analysis

(iii) Debt analysis

(iv) Dividend decision

(v) General business analysis

6. Limitations of Financial Statement Analysis

(i) Financial statement analysis ignore qualitative aspects like quality of management, labour force and public relations.

(ii) Suffering from the limitations of financial statements, which are as follows:

(a) Financial statements are historical in nature.

(b) Financial statements do not show price level changes hence, affect the analysis also.

(c) The results obtained by analysis of financial statements may be misleading due to window dressing.

(d) Financial statements are affected by the personal ability and bias of the analyst.

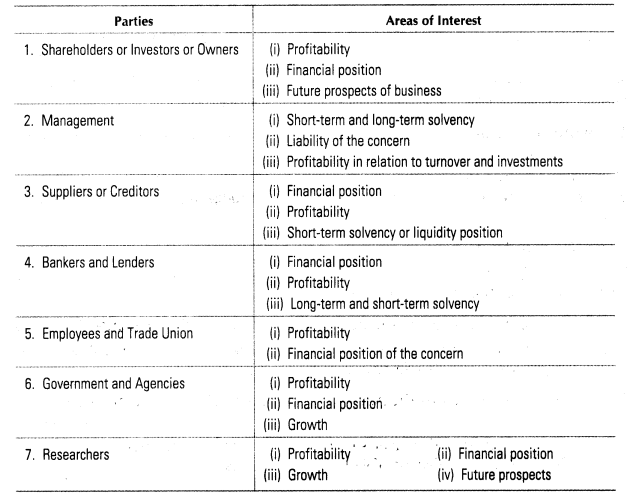

7. Parties Interested in Financial Statement Analysis and their Areas of Interest

Topic 2: Tools of Financial Statements Analysis

Tools of Financial Statements Analysis There are different tools of financial statements

analysis available to the analyst. The following tools are used to measure the operational efficiency and financial soundness of an enterprise.

The most common used techniques of financial analysis are:

1. Comparative financial statements

2. Common size statements

3. Ratio analysis

4. Cash flow statements

1. Comparative Financial Statements Statements used to compare the items of income statement i.e. profit and loss account and position statement i.e. balance sheet for ascertaining the trend of the performance and profitability of an enterprise are known as comparative financial statements.

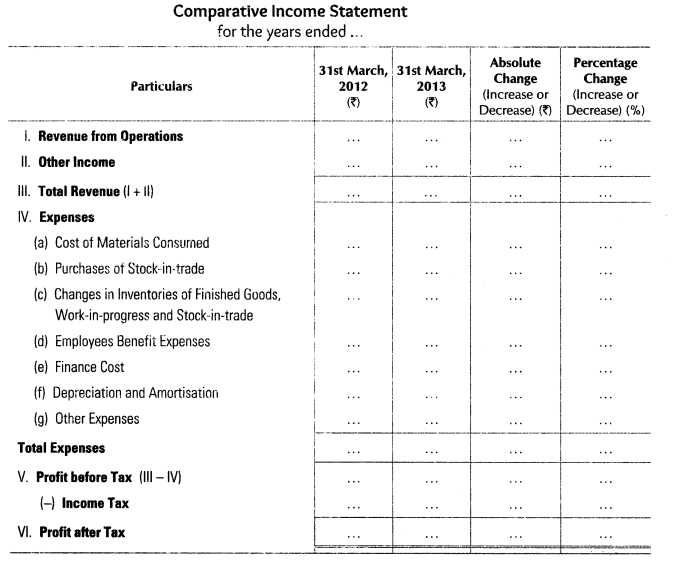

(i) Comparative income statement It is a statement which shows in percentage term the total of income earned and expenses incurred during two or more accounting periods.

Format of Comparative Income Statement

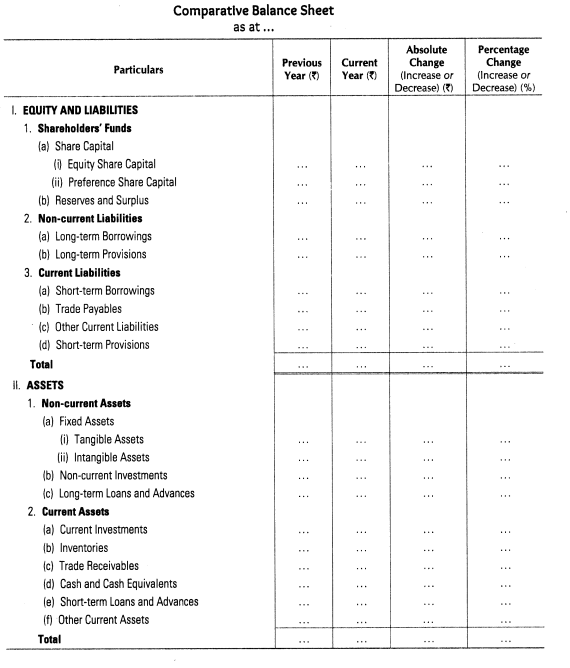

(ii) Comparative balance sheet. It is a statement showing assets and liabilities of the business for two or more accounting periods. It also shows the percentage change in the monetary value of the assets and liabilities.

Format of Comparative Balance Sheet

2. Common Size Statement The statement wherein figures reported are converted into percentage to some common base is known as common size statement. Each percentage shows the relation of the individual item to its respective total.

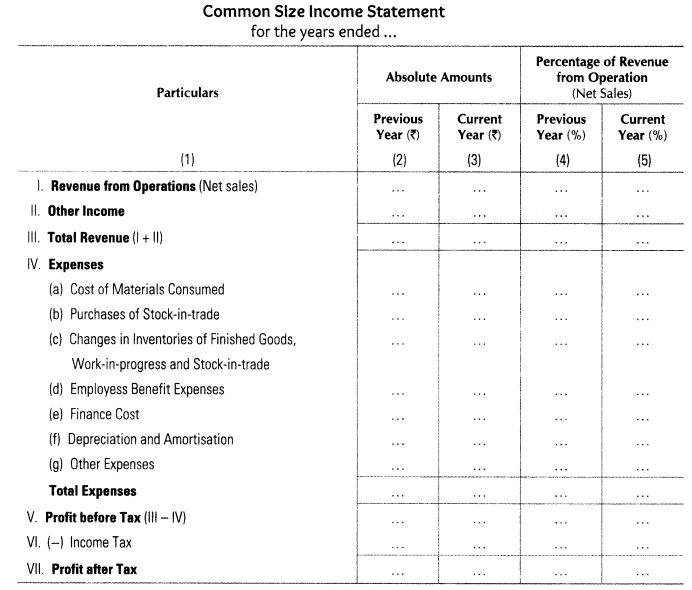

(i) Common-size income statement The statement in which sales figure is assumed to be 100 and all other figures are expressed as a percentage of sales is known as common size income statement.

Format of Common Size Income Statement

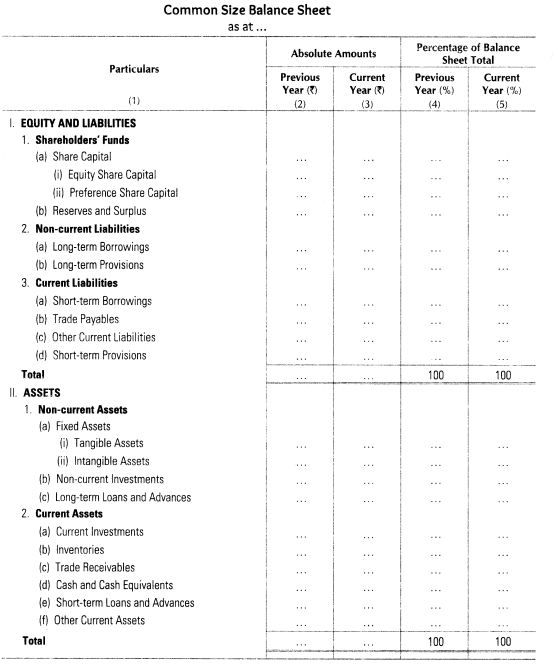

(ii) Common-size balance sheet In common size balance sheet, the total of assets or liabilities is assumed to be 100 and figures are expressed as a percentage of the total.

Format of Common Size Balance Sheet

3. Ratio Analysis The mathematical expression that shows the relationships between various groups of items contained in the financial statements is known as ratio analysis.

4. Cash Flow Statement It shows the inflows and outflows of cash and cash equivalents of an enterprise by classifying cash flows into operating, investing and financing activities during a particular period and analysing the reasons for changes in balance of cash between the two balance sheets dates.

Leave a Reply