Partnership Business (साझेदारी व्यवसाय) In Hindi

साझेदारी व्यवसाय एक प्रकार का व्यवसाय संगठन है जहाँ दो या दो से अधिक व्यक्ति, जिन्हें साझेदार कहा जाता है, मिलकर लाभ के लिए व्यवसाय चलाते हैं। इस प्रकार के व्यवसाय में साझेदार अपने संसाधनों, कौशल, और विशेषज्ञता को जोड़ते हैं और व्यवसाय स्थापित और चलाते हैं। साझेदारी एक कानूनी समझौते द्वारा नियंत्रित होती है, जिसे साझेदारी परिणामित समझौता कहा जाता है, जो साझेदारी की शर्तों और दशाओं को निर्धारित करता है। इसमें हर साझेदार की भूमिका, जिम्मेदारी, लाभ संवाहन का प्रकार, निर्णय लेने की प्रक्रिया, और व्यवसाय के अन्य प्रमुख पहलुओं को स्पष्ट किया जाता है। इस प्रकार के व्यवसाय कई रूपों में हो सकते हैं, जैसे कि सामान्य साझेदारी, सीमित साझेदारी, और सीमित दायित्व साझेदारी, प्रत्येक के अपने विशेषताएँ और कानूनी प्रभाव होते हैं।

Partnership Business In English

A partnership business is a type of business organization where two or more individuals, known as partners, come together with the aim of operating a business for profit. In a partnership, the partners pool their resources, skills, and expertise to establish and run the business. The partnership is governed by a legal agreement called a partnership deed, which outlines the terms and conditions of the partnership, including the roles and responsibilities of each partner, the profit-sharing arrangement, the decision-making process, and other relevant aspects of the business operation. Partnerships can take various forms, such as general partnerships, limited partnerships, and limited liability partnerships, each with its own characteristics and legal implications.

Types of Partnership

General Partnership:

1. In a general partnership, all partners share equally in the profits, losses, and management responsibilities of the business.

2. Each partner has unlimited liability, meaning they are personally responsible for the debts and obligations of the partnership.

3. Decisions are typically made jointly by all partners.

Limited Partnership:

1. A limited partnership consists of both general partners and limited partners.

2. General partners have unlimited liability and are actively involved in managing the business.

3. Limited partners contribute capital to the business but have limited liability, meaning their liability is restricted to the amount of capital they have invested.

4. Limited partners usually do not participate in the day-to-day management of the business.

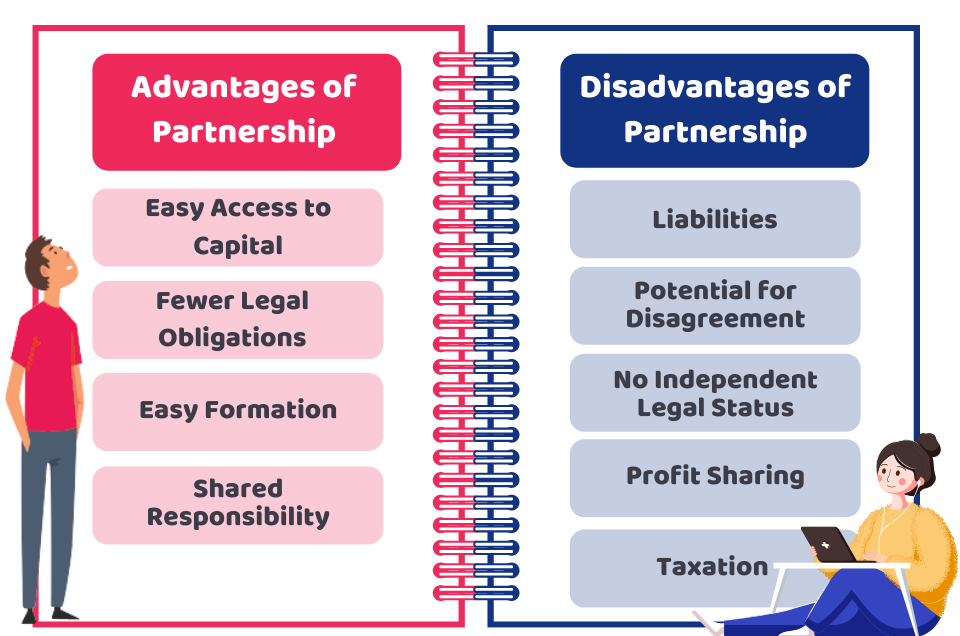

Advantages and Disadvantages of Partnership:

Ratio of Divisions of Gains

Simple Partnership (Equal Time):

If partners contribute capital and participate for an equal time, the profit is divided based on the ratio of their initial investments.

1. Let A invest X amount and B invest Y amount.

2. Their profit share ratio: A’s share : B’s share = X : Y

Leave a Reply